Having a HELOC gives you peace of mind and security for all of life’s unexpected events.

Access Cash without selling your home. If your retirement income isn’t enough to cover your expenses, you can use a HELOC to supplement it. This can be especially helpful if you have unexpected expenses or to cover the cost of long-term care.

The commercial and business credit market is tightening. Our HELOC can be used to fund your business for payroll, expansion, and capital improvements, and more.

With home equity at an all-time high our HELOC options could be a great lower rate alternative to costly student loans.

Nothing adds value to a home more than upgrades, additions, and improvements. Rest assured with a fixed amortizing monthly payment in terms of 5, 10, 15, 20, 25 and 30 year terms.

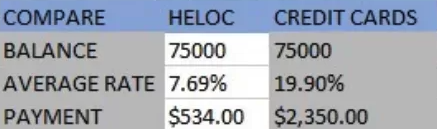

Re-Ignite your cashflow and free yourself from high interest installment and revolving debt into one lower amortizing monthly payment.