High Interest Debt can be a strain on your budget. A Home Equity Line of Credit may be the solution.

HELOC Inquiry

Please use the form below to start the process of learning how to qualify for a HELOC in Florida with Bay to Bay Lending. Processing times can be as fast as 5 business days.

Unlock the Potential of Your Home Equity with a HELOC

In today’s ever-changing economic landscape, it’s more important than ever to leverage your assets wisely. A Home Equity Line of Credit (HELOC) from Bay to Bay Lending can help you navigate the challenges of the current economic environment. Let’s explore how your HELOC can be a powerful financial tool.

What Can You Do with a HELOC?

In an era marked by economic uncertainty and rising costs, your home’s equity can be your financial lifeline. Here are some ways you can utilize your HELOC to address pressing economic concerns:

1. Tackle 401(k) Hardships

When unexpected financial hardships strike, your HELOC can provide a safety net, helping you avoid early withdrawal penalties from your retirement savings.

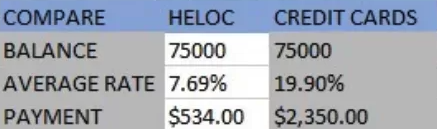

2. Manage All-Time High Credit Card Debt

With credit card debt reaching all-time highs, a HELOC can help you consolidate and pay off high-interest credit cards, saving you substantial amounts in interest payments.

3. Combat High-Interest Rates

In an environment of rising interest rates, a HELOC offers a potentially lower interest rate alternative, making it an attractive option for various financing needs.

4. Break the Cycle of Living Paycheck to Paycheck

If you find yourself struggling to make ends meet, a HELOC can provide the breathing room you need to regain financial stability and break the cycle of living paycheck to paycheck.

5. Cope with Inflation

As inflation continues to impact everyday expenses, your HELOC can be used strategically to cover rising costs without depleting your savings.

Why Choose Bay to Bay Lending in Tampa, Florida for Your HELOC?

At Bay to Bay Lending, we understand that economic challenges require smart financial solutions. Here’s why our HELOC options are designed to meet your needs:

Competitive Rates:

Our HELOCs come with competitive interest rates, allowing you to make the most of your home’s equity.

Flexible Terms:

Customize your HELOC to align with your financial goals and adapt to evolving economic conditions.

Expert Guidance:

Our experienced team is here to provide guidance and support, ensuring you make informed financial decisions in today’s economy.

Local Support:

As a trusted local partner, we’re dedicated to serving our community by offering financial solutions tailored to your unique circumstances.

Unlock the Potential of Your Home

Ready to leverage your home’s equity as a powerful financial tool in today’s economy? Apply for a HELOC with Bay to Bay Lending and take control of your financial future.

Contact Us Today

To learn more about our HELOC options and how they can help you navigate the current economic landscape, contact us today. Speak with one of our knowledgeable advisors and secure your financial stability in uncertain times.