Explaining Today’s Low Housing Supply [INFOGRAPHIC]

![Explaining Today’s Low Housing Supply [INFOGRAPHIC] Simplifying The Market](https://files.keepingcurrentmatters.com/content/images/20230928/Explaining-Todays-Low-Housing-Supply-KCM-Share.png)

Some Highlights

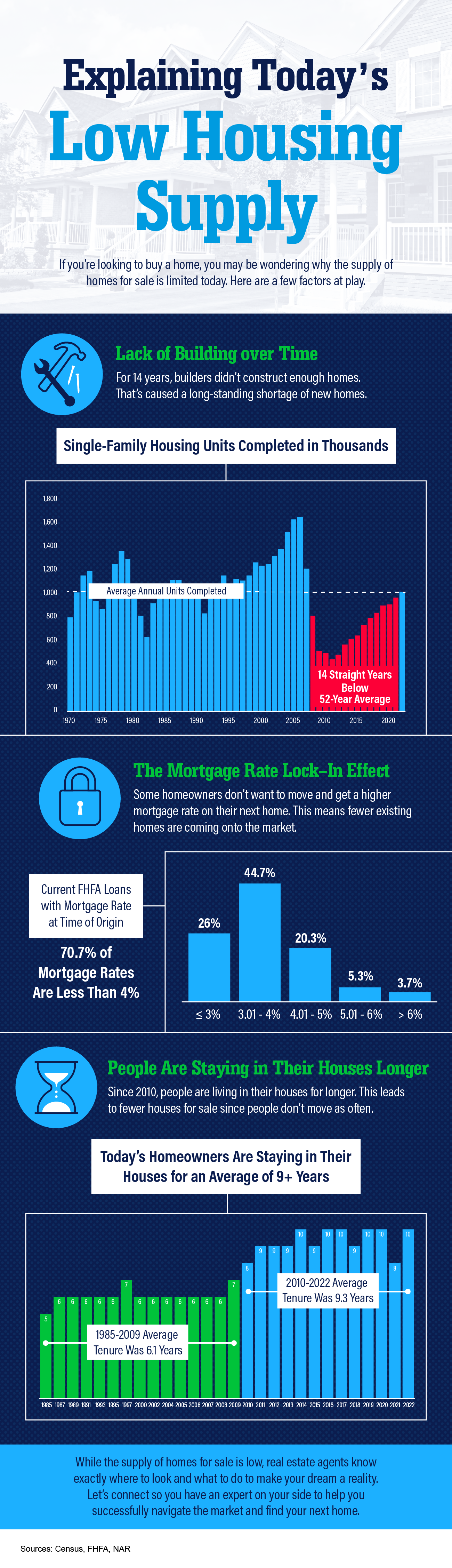

- Wondering why the supply of homes for sale is limited today? There are a few factors at play.

- Lack of building over time, the mortgage rate lock-in effect, and people staying in their houses longer are three of the main reasons why supply is low.

- But real estate agents know exactly where to look and what to do to make your dream a reality. Connect with an agent so you have an expert on your side to help you successfully navigate the market and find your next home.

![Today’s Housing Market Has Only Half the Usual Inventory [INFOGRAPHIC]](https://baytobaylending.com/wp-content/uploads/2023/08/Todays-Housing-Market-Has-Only-Half-the-Usual-Inventory-KCM-Share-720x410.png)

![Plenty of Buyers Are Still Active Today [INFOGRAPHIC]](https://baytobaylending.com/wp-content/uploads/2023/09/Plenty-of-Buyers-Are-Still-Active-Today-KCM-Share-720x410.png)